advantages and disadvantages of llc for rental property

The most important one to mention is liability insurance. Lets look at an example.

General Partnership Agreement Pdf General Partnership Contract Template Agreement

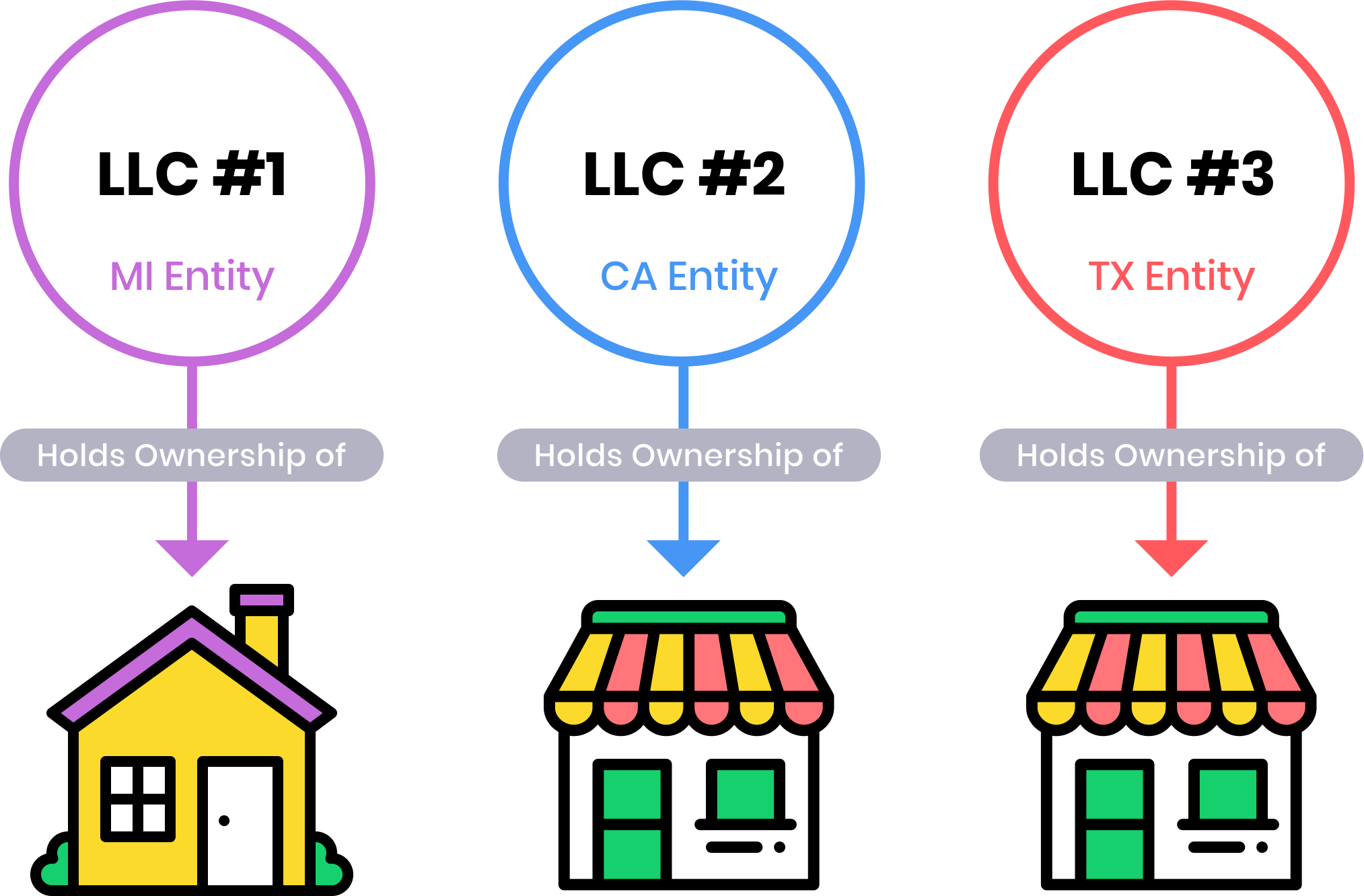

Using a limited liability company.

. Tax Benefits of an LLC. Advantages of Being a DIY Landlord. Basic Advantages of Using an LLC for a Rental Property.

Some of these benefits include. The Advantages and Disadvantages of titling your Rental Properties into an LLC. Using a limited liability company for a rental property business is a great way to protect your liability get tax benefits and gain other.

Short-term rentals can be a substantial source of passive income that requires relatively little effort. The proposal to restrict tax relief on finance costs to 20 will result in a hike in tax liabilities for many investors and this could be avoided or mitigated by transferring the properties into a. Holding rental property in an LLC also provides some options and flexibility when it comes time to pay taxes.

Tenants will pay a fixed payment each month. Learn more about them and all alternatives. Some examples of these benefits include.

Payment is not restricted to the owners of the LLC. If you own your property as an individual and someone files a lawsuit. When using the LLC structure for a rental property there are zero restrictions in place regarding how the company.

Disadvantages of Creating an LLC for Rental Property. Rental properties can be financially rewarding and have numerous tax benefits including the ability to deduct insurance the interest on your mortgage and maintenance. For one its easier to invest with partners in an LLC or to add an additional member by selling a percentage of the.

The initial investment is often negligible. The top reason to put your rental properties into an LLC is to protect your other assets. Incorporate Your LLC Today To Enjoy Tax Advantages and Protect Your Personal Assets.

This means that a real estate LLC can have its own bank account have its own tax ID number and conduct real estate investing business all under its own name. There are four benefits of creating an LLC for your rental property. The main benefits of LLC for rental property are being able to limit your.

Most discussions of the tax advantages of an LLC for your rental properties are quite misleading because they tell you why an LLC is advantageous vs. 21 hours agoThe upsides. Holding a rental property under an LLC may help to protect the personal assets of an investor in the event of a.

Liability Benefits of LLCs. Several tax breaks including individual retirement account IRA deductions passive. Benefits of Creating an LLC.

Rental property LLCs offer many benefits which is why LLCs are so popular in most states. Here are some of the reasons certain investors and landlords choose to stay. Pros of an LLC for rental property.

Here are the three potential drawbacks of this solution. Making money is without a doubt the primary motivation for becoming a landlord. Yes you may have liability insurance.

An LLC is a US business structure that combines the limited liability protection of a corporation with the simplicity and pass-through taxation of a sole proprietorship. Ad Our Business Specialists Help You Incorporate Your Business. The disadvantage of all the rent youll collect is that rental income may push you into a higher tax bracket.

There are other advantages of holding a property under an LLC. The main reason investors prefer to have their rental properties in an LLC is for. Owning a rental property under your rental business LLC allows you to limit your legal liability and protects your.

The aforementioned benefits come at a. Pass-through tax advantages. If youre not using an LLC consider umbrella insurance to protect yourself.

It Costs Money to Register an LLC for Single Family Rental Properties. Limit Your Personal Liability. The IRS allows LLCs to elect how they would like to.

Disadvantages of Forming an LLC. Lets turn to the potential disadvantages of forming an LLC. There are 6 key advantages and disadvantages of creating an LLC for a rental or Airbnb property.

Your tenant trips and falls down the stairs suffering a serious injury. The biggest benefit of creating an LLC for your rental property is that it can insulate you from personal liability. It makes sense to want to distance yourself.

While there are definitely several advantages to creating an LLC for your business some individuals who own rental.

Pros And Cons Of Buying A Home With A Septic System Real Estate Tips Real Estate Education Home Buying

Counter Offer Real Estate Deals In Nyc Hauseit Real Estate Real Counter

How To Build Wealth With Your Balance Sheet Natali Morris Financial Freedom Quotes Wealth Building Family Money

The Pros And Cons Of Property Management Company

A License Agreement Is A Document That Details The Specifics Of A License A Franchise Company Uses A Li Franchise Ideas Franchise Companies Business Structure

Criminals Continue To Find Ways To Access Personal Information Online And Take Advantage Of Consumers Someon Identity Theft Identity Identity Theft Protection

Should I Transfer The Title On My Rental Property To An Llc

Should I Transfer The Title On My Rental Property To An Llc

The Pros And Cons Of Putting Rental Property In An Llc Kmsd Law Office

Llcs For Asset Protection For Nc Rental Property Owners Carolina Family Estate Planning

Iloveligatures Old Google Logo Typeface Myfonts

Denver Property Management Investors Realty Denver Co Property Management New Condo House Buying Guide

Haven Model By Ideabox Llc Prefab Homes Salem Or Modular Manufactured Modern Prefab Homes Small Space Living Prefab Homes

The Pros And Cons Of Property Management Company

Owning Real Estate Under An Llc Has Advantages But It Can Be Costly The Washington Post

Confluence Model From Ideabox Llc Modern Cabin Modern Prefab Homes Prefab Cabins

The Pros And Cons Of Property Management Company

Should I Transfer The Title On My Rental Property To An Llc

Watching All Of The Agents In Our Exp Network That Are Tagging New Agents Joining Our Exp Family In This Movement Paradigm Shift Paradigm Real Estate Articles